Brutal Tax Hikes That Could Erode Your Buying Power

Update: As of the date of this update, the proposed VAT increase in South Africa has been redacted. VAT will remain at 15%.

On March 12, 2025, Finance Minister Enoch Godongwana delivered a budget speech that outlined the government’s fiscal roadmap for the year ahead. With economic growth remaining sluggish, high unemployment, and an ever-increasing cost of living, South Africans were hoping for some relief. However, key budgetary decisions—particularly Value Added Tax increases (VAT), the absence of personal income tax bracket adjustments, and a hike in transfer duties—suggest that everyday citizens will have to navigate another financially challenging year due to rising tax increases across the board.

While businesses and investors will certainly feel the effects of these measures, this article focuses on how these changes impact everyday South Africans, from low-income workers to middle-class families and high-net-worth individuals.

VAT Increase: A Costly Adjustment for Households

Perhaps the most immediate and widespread impact of the 2025 budget is the planned increase in VAT—South Africa’s consumption tax on goods and services. The increase will be phased in over two years;

- From 1 May 2025: VAT rises from 15% to 15.5%

- From 1 April 2026: VAT rises further to 16%

This might seem like a small increase, but the reality is that VAT affects nearly every purchase made by South Africans, from groceries to electricity, school supplies, and fuel. Tax increases like this one directly affect consumer behaviour and overall affordability.

Impact on Different Households

Low-Income Earners:

For lower-income households, the VAT increase is particularly burdensome, as a large portion of their income is spent on necessities. While the government has tried to soften the impact by adding new zero-rated food items (such as more meat, vegetables, and dairy liquid blends), these do not cover all essential household purchases. Items like cleaning products, toiletries, school uniforms, and prepaid electricity will now cost more. These tax increases come at a time when income growth is stagnant and savings are minimal for the most vulnerable groups.

Additionally, many informal traders and spaza shop owners who sell VAT-inclusive goods may find it difficult to absorb the costs, passing them on to consumers instead.

Middle-Class Professionals:

For salaried workers, the VAT hike means higher monthly expenses on everything from transport to dining out, entertainment, and home essentials. These individuals may not qualify for social grants or subsidies, leaving them to absorb the rising costs with no immediate financial relief. The combination of bracket creep and indirect tax increases is gradually eroding their disposable income.

With an already high cost of living, including medical aid, school fees, and car repayments, many middle-income earners may have to cut back on non-essential spending or reconsider financial commitments, such as holiday plans or home renovations.

High-Income Earners:

Affluent individuals who spend more on luxury goods and imported items will feel the VAT hike in high-ticket purchases, such as electronics, vehicles, and international travel. However, for this group, VAT is more of a nuisance than a financial constraint, as their higher disposable income allows them to absorb these costs more easily.

Which Additional Items Are Now VAT Zero-Rated?

To help ease the financial impact of the VAT increase, the government has expanded the basket of zero-rated food items, meaning these products will not be subject to VAT at the new higher rates (15.5% in 2025 and 16% in 2026).

The following new items will be VAT-free from May 1, 2025:

- Edible Offal (various cuts including livers, hearts, kidneys, soup bones, trotters, and tripe)

- Dairy Liquid Blends (including high-fat, full-fat, medium-fat, low-fat, and fat-free blends)

- Canned Vegetables, including:

- Dried and tinned beans

- Green peas (fresh and tinned)

- Dried peas (tinned)

How This Helps Households

For low-income and middle-class families, these additions mean certain staple foods will not become more expensive due to VAT increases.

- Offal and canned vegetables are widely consumed by budget-conscious households, so making them VAT-free provides a small but important financial relief.

- Dairy liquid blends are a nutritious alternative to regular milk and will now be more affordable.

Limitations of Zero-Rated Relief

While the expanded zero-rated list is helpful, it’s important to note:

1) Many other basic essentials remain subject to VAT—such as cooking oil, baby products, and sanitary items, meaning household expenses will still increase overall.

2) Implementation could be slow, as retailers must update their systems, which may cause price discrepancies in the short term.

3) Uncertainty remains as to whether the bill enacting these changes will be passed before the first VAT increase on May 1, 2025. If not, consumers could temporarily miss out on these savings.

Conclusion on VAT and Zero-Rated Items

While the addition of new VAT-free food items is welcome, it does not fully offset the impact of the broader VAT increase on everyday living expenses. Households will still need to carefully manage budgets as overall shopping bills are likely to rise.

No Changes to Personal Income Tax: The Silent Tax Increase

While the government did not increase personal income tax rates, it also did not adjust tax brackets for inflation. This means South Africans will end up paying more tax without realizing it, due to a concept called bracket creep – a subtle form of tax increases that quietly tightens household budgets

What is Bracket Creep?

Bracket creep happens when inflation pushes salaries up, but tax brackets remain unchanged. This leads to higher tax payments without an actual increase in purchasing power. Making it one of the most underestimated tax increases in the system.

How Different Income Groups Are Affected

Low-Income Earners:

For those earning below R95,750 per year, the tax threshold remains unchanged, meaning they don’t pay income tax. However, they will still experience higher living costs due to the VAT hike, rising food prices, and increasing transportation expenses.

Middle-Class South Africans:

Middle-income earners will feel this silent tax increase the most. Without inflationary adjustments to tax brackets, those who receive small salary increases may find themselves pushed into higher tax brackets—paying a larger percentage of their income in tax.

For example:

- A person earning R500,000 per year may get a 6% salary increase (R30,000). However, because tax brackets are unchanged, a bigger portion of this increase is taxed at 36% instead of 31%, reducing their actual take-home pay.

- The result? Higher taxes, reduced disposable income, and greater financial strain.

High-Income Earners:

Wealthier individuals in the R1.8 million+ tax bracket (who are taxed at 45%) will continue to be taxed at the same rate. However, without bracket adjustments, they will still lose more of their salary increases to higher taxes, compounding the overall tax burden.

What This Means for Everyday South Africans

- Workers will feel poorer despite earning slightly more.

- Cost-of-living increases will outpace income growth.

- More South Africans may look for tax-saving strategies, such as contributing to retirement funds or exploring tax-efficient investment options.

Higher Transfer Duty: Making Homeownership More Expensive

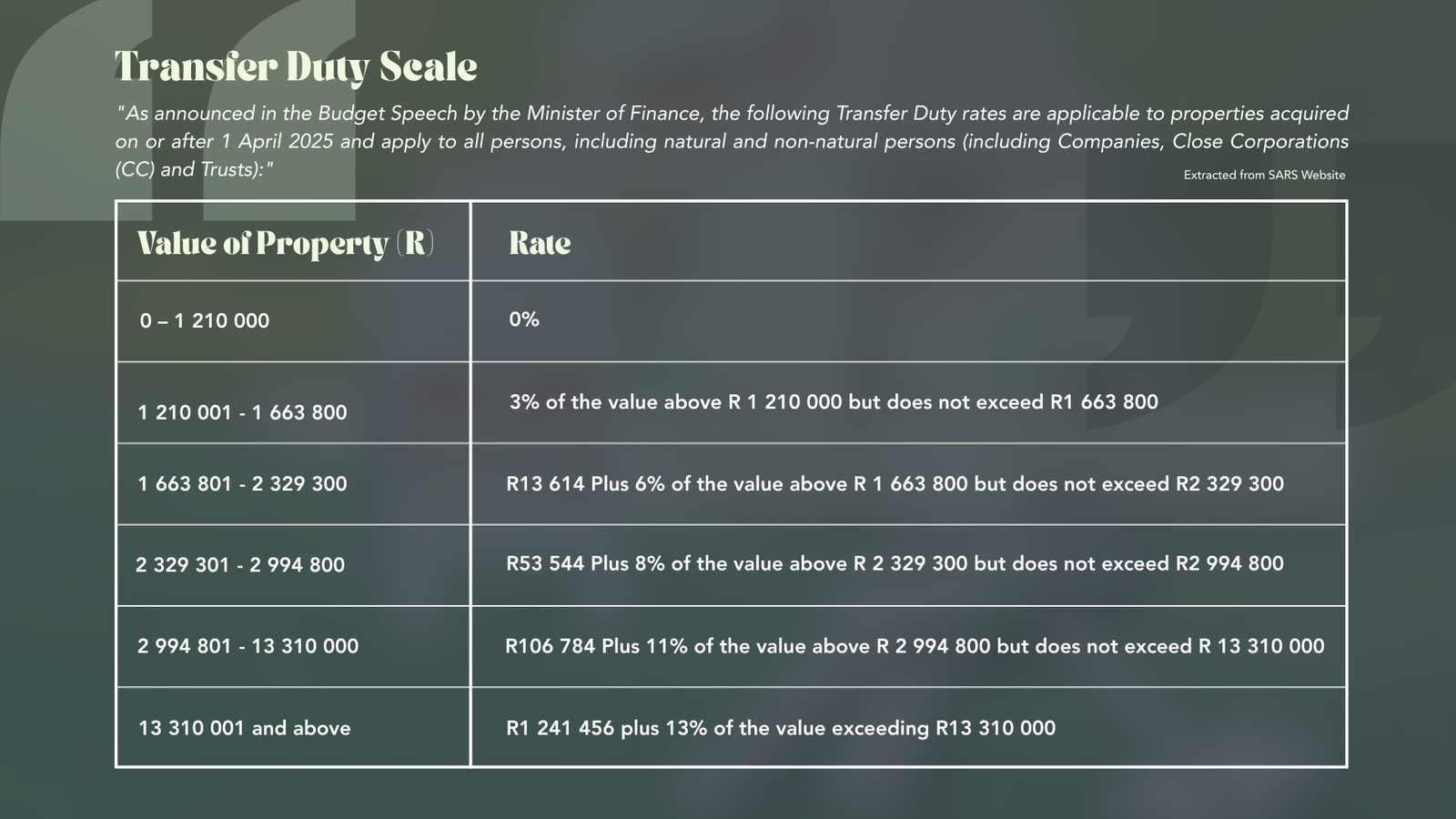

Another major change is the 10% increase in Transfer Duty. Transfer Duty is a tax paid to SARS when purchasing property over a certain value. This affects both first-time buyers and property investors, increasing the cost of homeownership. It forms part of the broader tax increases that target property transactions in this budget cycle.

However, it’s not all bad news. The threshold for transfer duty exemption has also increased by 10%, meaning that properties valued up to R1,210,000 are now exempt from transfer duty. This adjustment brings some relief to aspiring homeowners—particularly those in the lower-to-middle income bracket—by lowering the barrier to entry into the property market.

How It Affects Different Groups:

First-Time Homebuyers & Middle-Class Families:

Buying a home in South Africa is already expensive, and while the higher transfer duty raises costs, the increased exemption threshold helps cushion the blow for entry-level buyers.

For example:

- Someone buying a home for R1,200,000 will now pay no transfer duty—potentially saving tens of thousands compared to previous years.

- However, those buying slightly more expensive properties, such as a R2 million home, will still face higher duties on the amount above the exemption threshold, alongside legal and financing costs.

- The result is a mixed picture: greater affordability at the bottom end, but higher costs in the mid-tier segment.

- Visit the SARS official website for the full Transfer Duty Scales.

Property Investors & High-Income Earners:

- Investors targeting high-end properties will feel the pinch more severely, particularly for homes above R13.3 million, where transfer duty rates are steepest. This could dampen activity in the luxury property segment, potentially slowing new luxury development projects and speculative buying.

The Housing Market and the Bigger Economic Picture

The full impact of higher transfer duties on the property market depends largely on broader economic conditions. Several key factors will shape housing demand and affordability throughout 2025:

- Interest Rate Decisions by the South African Reserve Bank (SARB):

- The cost of borrowing will be crucial in determining whether people can afford new homes. If SARB decides to cut interest rates later in 2025, this could make mortgage repayments more affordable and offset some of the increased transfer duty costs.

- However, if rates remain unchanged or increase, many buyers will struggle to secure financing, further dampening the housing market.

- Global Trade Uncertainty and Economic Growth:

- The ongoing trade tensions between the United States and key global economies—could have a knock-on effect on South Africa’s economy, particularly in sectors like mining, agriculture, and manufacturing.

- If global trade disruptions lead to weaker exports and a weaker rand, inflation could rise, further tightening consumer spending power. This would make both everyday expenses and homeownership even more challenging.

- Job Market and Economic Stability:

- South Africa’s unemployment rate remains high, and if economic growth continues to stagnate, potential homebuyers may lack the confidence to enter the property market.

Impact on the Housing Market:

- Sellers may struggle to find buyers willing to pay the additional tax.

- Estate agents may see slower property transactions, as affordability becomes a bigger issue.

- Rental demand may increase, as more people opt to rent instead of buy.

Sin Tax: Higher Costs for Alcohol and Tobacco Consumers

Every year, South Africans brace for Sin Tax increases, which affect the cost of alcohol, tobacco, and sugary beverages. In the 2025 budget, the government has significantly raised excise duties on these items in an effort to boost revenue and promote public health.

What’s Changing?

- Alcohol: Beer, wine, and spirits now carry an average excise duty increase of 10%, making a six-pack of beer or a bottle of whiskey noticeably more expensive.

- Cigarettes & Tobacco: The tax on a pack of cigarettes has increased by R3, further pushing up the cost of smoking.

- Sugary Beverages: The Health Promotion Levy (commonly known as the sugar tax) has also been increased by 7%, making soft drinks and sweetened beverages more expensive.

Public Health vs. Government Revenue:

While sin tax hikes are justified as a public health measure, their primary motivation is revenue generation. The government expects to raise billions in additional tax revenue from these hikes, but whether they effectively curb alcohol and tobacco consumption remains debatable.

Final Thoughts: A Tough Year Ahead for Households

The 2025 budget introduces several tax measures that will make life more expensive for everyday South Africans:

- VAT increases will raise the cost of living for all income groups.

- No personal income tax adjustments mean South Africans will pay more tax in real terms.

- Higher transfer duties will make homeownership even harder.

- Sin Tax hikes will increase the cost of alcohol, cigarettes, and sugary beverages, squeezing disposable income.

The bigger economic picture, including global trade conditions, SARB’s interest rate decisions, and job market performance, will play a crucial role in determining whether South African households can manage these financial pressures.

How Can South Africans Prepare?

- Budget carefully to accommodate rising costs.

- Explore tax-efficient savings options, such as retirement annuities.

- Track SARB’s interest rate decisions, as these will influence home loans and debt repayments.

- Consider cutting back on discretionary spending, including alcohol and tobacco, where possible.

At KO Strategic Advisors, we help individuals and businesses navigate these financial shifts effectively. Stay informed, plan ahead, and make smart financial decisions to weather the impact of Budget 2025.